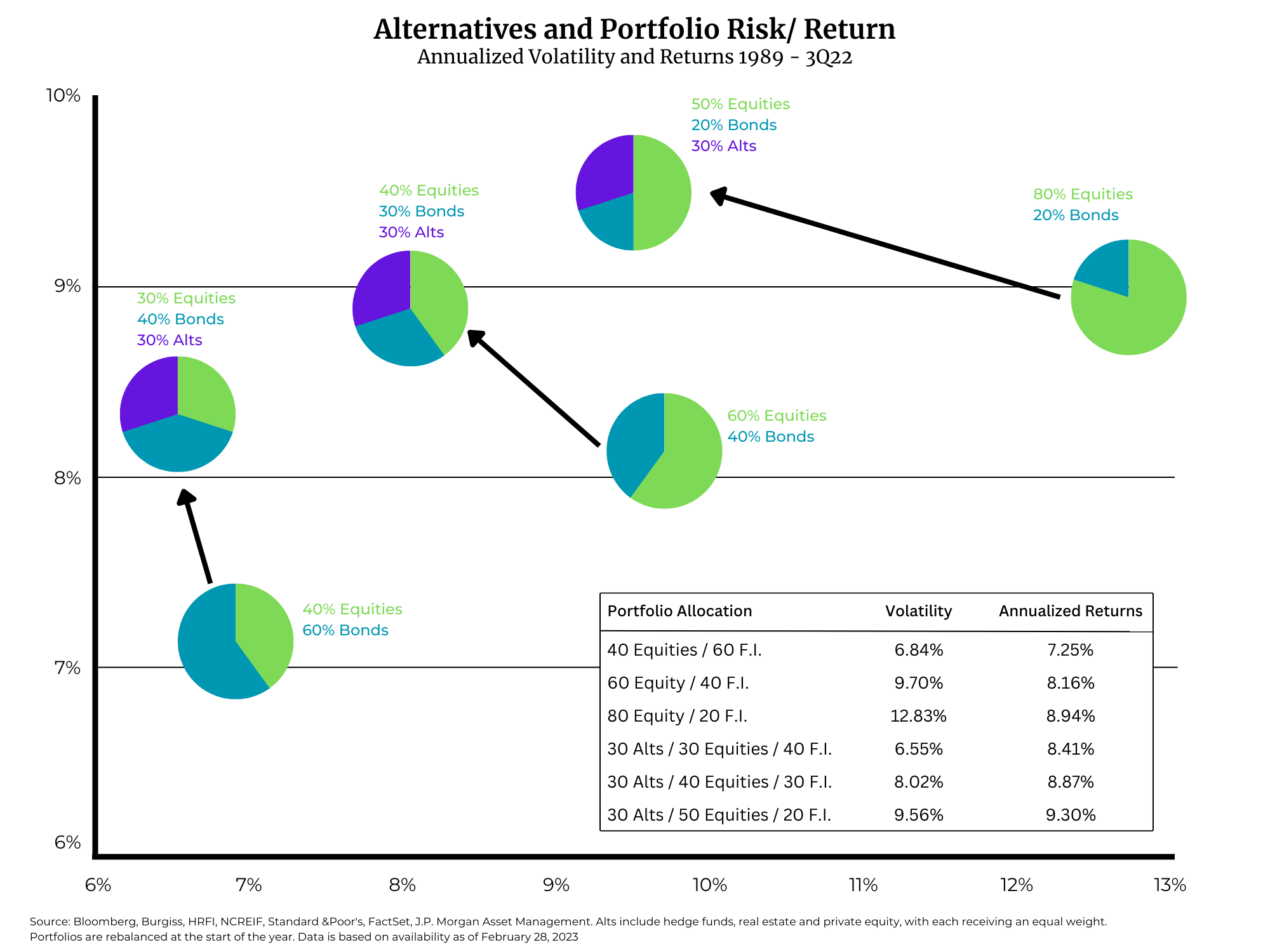

The traditional investment portfolio allocation, 60% equities/40% bonds, is established wisdom for many investors and financial advisors. But in recent years, alternative investments – long-term, illiquid, private equity/venture capital allocations – have come into their own. More and more investors have found that these non-correlated privately managed funds provide stability, income, tax advantages and higher returns than many traditional investments. A recent study, the February 2023 JP Morgan Guide to Alternatives, showed that a portfolio balanced at 50/20/30, with 30% allocated to alternatives, outperformed all other models, including 60/40, with substantially less volatility over a ten-year period.

It seems clear that financial advisors should be recommending alternative investments to their clients to be truly diversified in their portfolios. Many advisors continue to hesitate. But as advisor awareness and adoption of alternatives grows, only the most ready-for-primetime funds will be considered. Not only return on investment and non-correlation but stability and accuracy on the fund administration side will be required. The investor experience and responsiveness to the needs of advisors will be critical considerations and professionalized fund administration will be key.

Outsourced Fund Administration

Traditionally, it was easy for fund sponsors to think that they could save the cost of outsourced fund administration with a home-grown team and improvised systems for accounting and shareholder management. Forward thinking and ambitious fund managers always saw the value in a specialized fund administration partner to navigate fund operations but as alternative investments enter the mainstream – with increased advisor adoption, regulatory scrutiny and investor demands – the prospect of employing an amateur in-house team will become unthinkable. Many institutional investors already consider in-house fund administration an unacceptable business risk for candidate funds. Retail investors and their financial advisors are reaching the same conclusion.

Fund Administration in the Age of Alternatives

A competitive advantage for any private fund manager is the ability to focus on investments and sales without the distraction of fund administration. A professional fund administration partner makes this possible. With more retail investor dollars than ever in the market for alternatives, the fund sponsor’s return on an investment in fund administration becomes an essential bottom line consideration.

Investor Expectation for Fund Administration

Well advised investors are willing to accept years of illiquidity for a portion of their portfolio as a trade-off for the many benefits an alternative investment offers but failures of fund administration – lack of transparency, late payments, inaccurate reporting, lost tax documents – will shake investor confidence not only in the product sponsor but in the advisor who recommended the investment. Professionalism and reliability are what matter to investors during years of inactivity in a private fund investment. The performance of the fund administration team, not just the fund manager, is the basis on which investors form their impression of the general competence of the firm. If 30% for an investor’s capital is deployed in a private equity or venture capital fund, that investor will expect the experience of that investment to be as much like the other 70% as possible. Any why shouldn’t it be?

The Economics of Fund Administration

Above all, investors expect fund managers to be good investors – to know value and potential when they see it. The value of an investment in fund administration should be considered on the same terms as an investment in a portfolio asset. Rather than employ, train, equip and manage and in-house team of employees at the expense of the management company, outsourced, specialized fund administration with its flexibility of work-flow and economies of scale shows commitment to the investor experience, concern for the focus of management, a thoughtful counting of costs and an appropriate confidence in an efficient division of labor to the benefit of all parties.

Growing Confidence in 50/20/30

Advisors will need to become confident about incorporating alternatives into their practices and fund administration will be part of that process. The benefits of alternatives for client investors become more compelling every year but a reputation for a rocky investor experience due to inadequate fund administration will disqualify many fund sponsors and slow the adoption of alternatives for many advisors. Private funds have a clear place today in the portfolio of every investor but only if specialized fund administration contributes to the confidence of investors and advisors to take the leap.