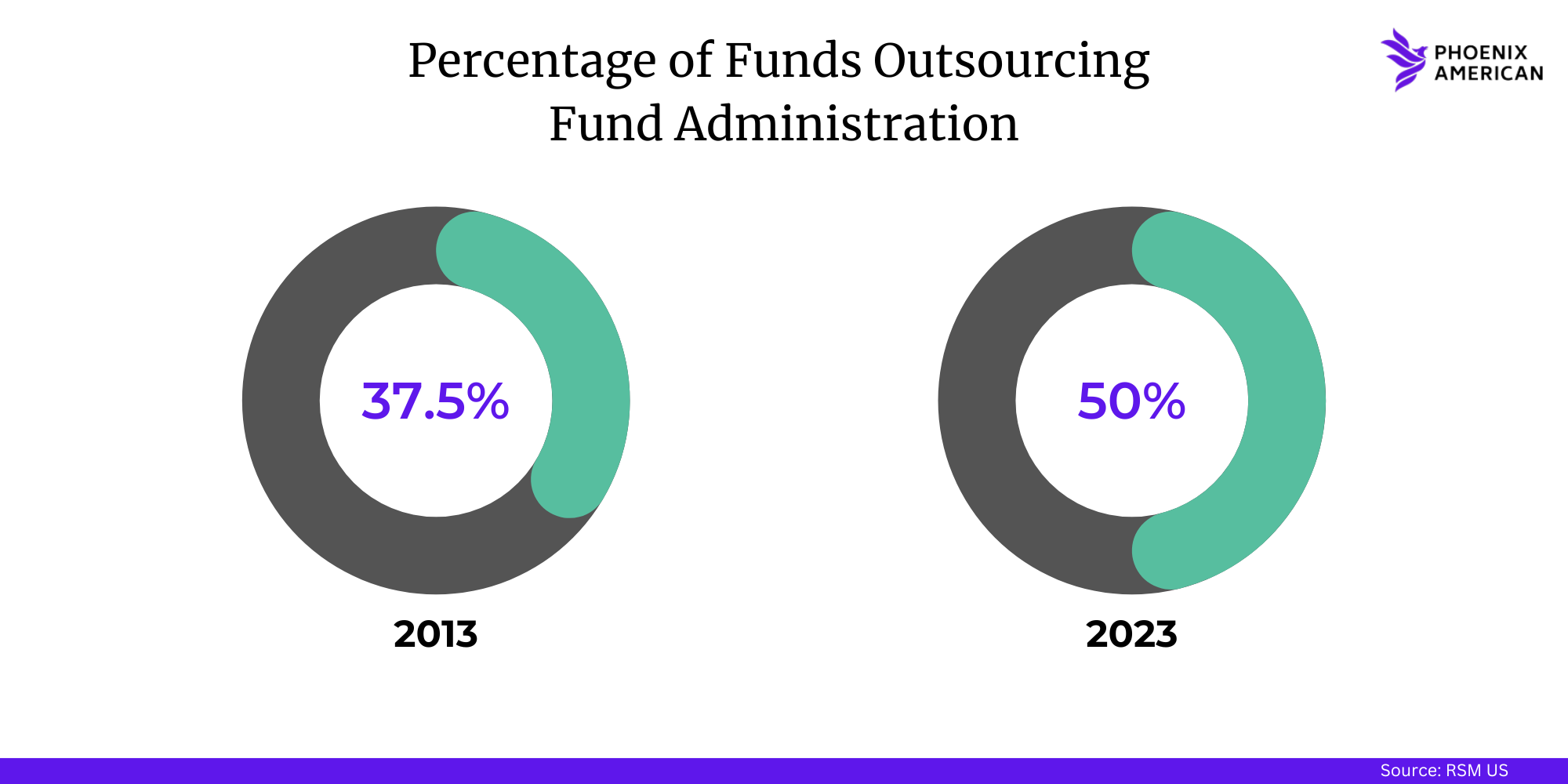

In the early days of private equity and venture capital funds were small face-to-face partnerships easily serviced by internal employees or an accounting firm. Fund administration was not a role considered necessary for a private fund. But as alternative investments have matured and entered the mainstream, the need for investor relations at scale, instant communication with financial advisors and other industry players, compliance with regulatory regimes and competition among fund sponsors for investor dollars have driven a trend toward professionalism and technological sophistication for every aspect of a fund’s operation. Today, third-party fund administration is increasingly considered indispensable for fund managers.

There are 10 principal factors driving the outsourcing trend.

1. An effective division of labor makes any organization its most efficient. Investment fund managers have expertise in raising investor capital and making lucrative investments. Portfolio accounting, shareholder management and financial communications are specialized fund administration functions subject to considerable investor demands and regulatory scrutiny. A fund administration firm has the specific knowledge of processes and specialized fund administration software to perform these functions most effectively. Management benefits from the perspective, experience and knowledge of operational complexities only a fund administration expert can provide.

2. Fund administration saves management costs as pricing is based on services rendered. Fixed payroll costs for an in-house team are substantial and are often not in line with the back-office demands of a fund at any given time.

3. Fund administration services scale smoothly with the growth of a fund. Sales success can be a liability for a fund when hundreds or thousands of new investors become an unmanageable burden on in-house administration processes. Advanced fund administration software applications operated by a well-equipped fund administrator are capable of managing at a functionally limitless scale. Staffing flexibility within a fund administration provider is able to respond to increases in scale providing as-needed operational staff to ensure continuity of service eliminating the need for fund management to hire, train and provide office space and benefits for additional personnel as the fund grows.

4. Multiple share classes, reinvestment plans, and complex fund structures can be difficult or impossible to manage with an in-house team. The specialized systems and experience of a fund administration provider gives fund management the flexibility to pursue business strategies that would otherwise be operationally challenging.

5. Regulatory compliance, data security and business continuity is systematized by the technology and processes of a fund administrator and removed as a source of business risk. Fund administration providers that are SEC-registered and Service Organization Controls (SOC) audited adhere to exacting performance standards and data security protocols.

6. Fund administration represents the best use of investor funds in the service of the investors. Professional outsourced investor-focused services delivered with cost-effective efficiency are recognized and appreciated as a prudent fund expense.

7. Connectivity with industry participants such as wire houses, broker-dealers, clearing firms, RIAs and family offices is built into advanced fund administration software applications, maximizing the visibility of fund management’s products and streamlining processes involving outside parties.

8. Management benefits from their fund administrator’s operational knowledge and insights derived from its other clients, its history and its industry relationships. Fund administrators are acutely aware of changes in regulation, best practices and the most efficient structures and processes for managing various types of funds and strategies.

9. Institutional investors, in their due diligence process, typically consider outsourced fund administration essential infrastructure for a fund in which they will invest. Pension funds, family offices and ultra-high-net-worth individuals recognize the importance of a professionalized division of labor.

10. The sales reporting capabilities of some fund administration software applications leverage sales, transaction and historical data to provide valuable business intelligence to wholesalers helping to drive new investment sales.

Fund administration is one of the best investments a fund manager can make. Beyond providing operational efficiency and cost savings in back-office functions, a fund administration firm represents a valuable industry partner in a position to promote the success of their client funds in multiple ways.