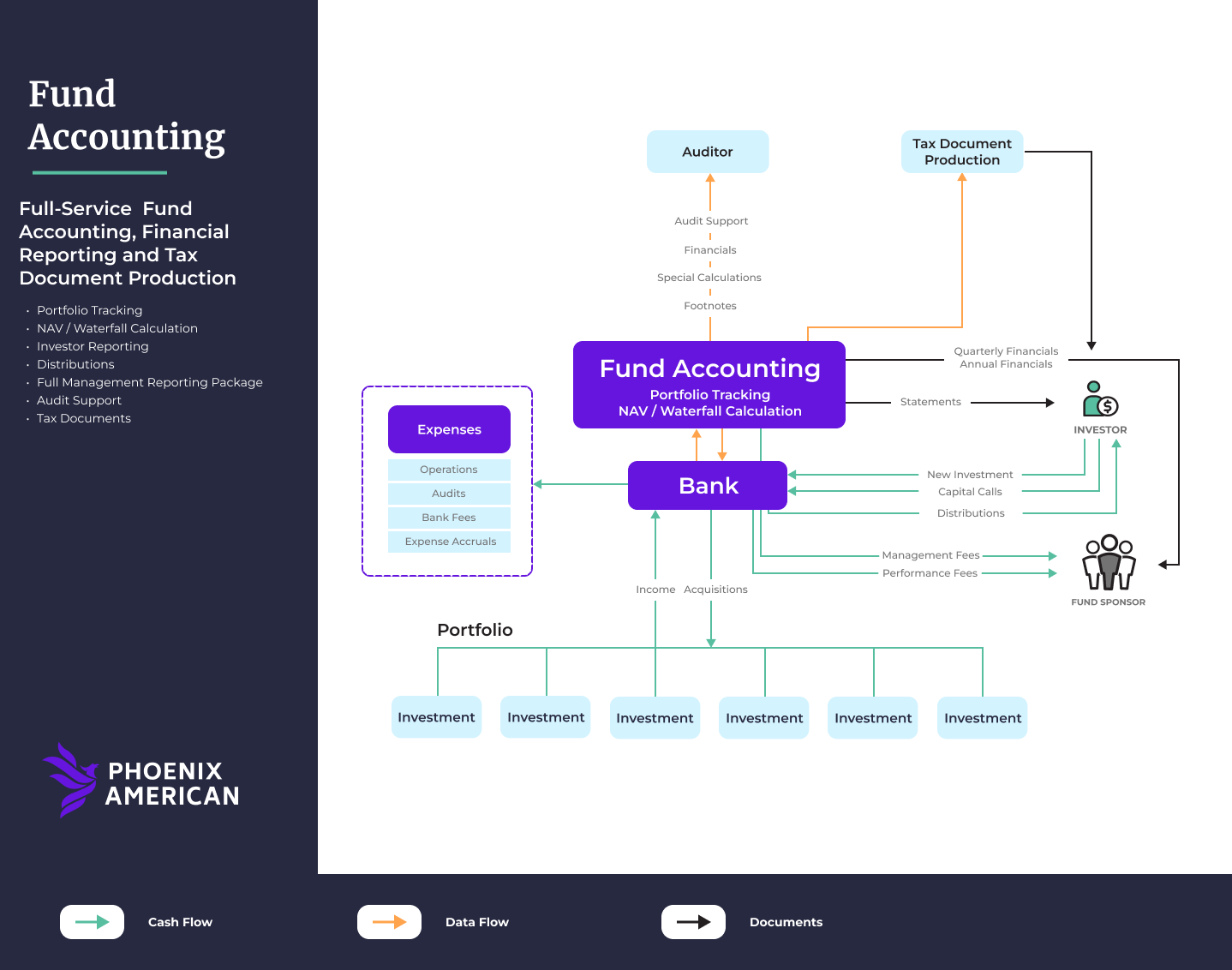

Capital is the lifeblood of your investment fund. Your ability to raise and deploy capital effectively is the expertise you bring to investment management. How to account for your capital flow, manage its movements and report on it with accuracy, clarity and compliance is the critical task of a fund accounting team. How your fund will operate with regard to capital flow should be discussed in detail at the outset of working with your fund accounting group. For a smooth workflow, you need to establish with a coherent fund accounting process that reflects the way you do business, avoids errors and misunderstandings and prevents audit inquiries that can cost unnecessary time and money. A clear fund accounting game plan will also streamline and automate many essential functions that would otherwise cost time and money on an ongoing basis.

Capital Contributions and Fund Accounting

Capital contributions to the fund are the first concern for fund accounting. How capital comes into the fund and how it is tracked will be important for distributions, capital calls and audit purposes. If there are multiple share classes, general partners and limited partners, multiple dividend rates or legacy investors assigned into the fund, all this needs to be coded and tracked by fund accounting at the outset for accurate payments and financial reporting. Just a few things to consider include:

- Does historical activity need to be maintained to account for break points and thresholds?

- Will investors receive warrants? How will they need to be tracked?

- Will in-kind contributions be accepted? If so, how will any excess value be allocated? Will the investor be treated differently in any way?

- Will the general partner be allocating carried interest into the fund?

- Might the manager be paid in equity rather than cash for consulting fees, management fees, or other services?

- Are there different distribution terms for different categories of investors, perhaps all the investors with a given custodian?

- Are there side letters?

- What provisions are in place in the event of deaths, divorces and other upheavals among investors going forward?

Of course, all these considerations must be allowed by the operating agreement or LPA, which should provide terms for handling each. Implementing them operationally will go smoothly only if they are contemplated and appropriately encoded by fund accounting during set up.

Capital Calls and Fund Accounting

There are a number of important fund accounting decisions with regard to capital calls that need to be made at the outset as well. First, the content of the capital call itself. It is worth considering in advance in consultation with fund accounting how much and of what kind of information should be included in your capital calls to avoid confusion and unnecessary questions.

- How detailed do you want capital calls to be?

- How much detail is too much?

- Will they include banking information, and contact information?

- Will the investor’s pro-rata share of the fund be referenced?

- Will your capital call reference what investment the specific tranche of called capital is for?

A capital call can be as detailed as you want. But there is such a thing as too much information. The tracking fund accounting deploys when setting up the fund will be important in preparing your capital calls.

- Are there parameters for investors who have contributed a certain amount?

- Are there cash limits? ERISA investors may be subject to percentage limits, opt outs, and prohibitions on derivatives, credit default swaps and commingled funds. They will be unable to participate in some investments and, with proper tracking, will be automatically omitted from the capital call.

- Institutional funds may have percentage limits and exclusions that disqualify them from a given capital call.

The more any of these special provisions are understood by fund accounting and encoded during set up, the more effortlessly capital calls can be produced.

Capital Statements and Fund Accounting

Capital Statements require the same considerations as capital calls as to how much information to provide. How much does the investor want and need to know? How much will only foster confusion and time-consuming questions? This particularly becomes an issue if you have institutional investors.

Pension funds, endowments and large foundations may belong to a trade organization called the Institutional Limited Partner Association (ILPA). Because institutions demand maximum visibility and due diligence for their stakeholders, ILPA recommends its members require financial reporting from their portfolio investment funds that adheres to the ‘ILPA Reporting Template’. This is a vast, exhaustive reporting package that goes into granular detail on portfolio performance, compensation rates, expenses, depreciations and every possible line item and metric of the fund as well as detailed reporting on the fund’s adherence to any and all limitations on portfolio investments to which the institutional is subject.

Production of the ILPA template is system-intensive and time-consuming, even for the fund accounting providers that are capable of producing it. It is well beyond the computational capability (and server capacity) of many fund accounting providers. Of course, the ILPA template includes far more information than you want to send to any non-institutional investor. That would be prohibitively expensive and would only confuse and overwhelm investors who are primarily interested only in the bottom line. So, if you intend to have institutional investors, you will need a fund accounting team familiar with and capable of producing the ILPA template and you must produce a separate statement for the rest of your investors.

Quality of Output

The physical quality of your investor statements is also an important consideration. Your statements are a regular reminder to your investors of the strength and stability of your brand. You should know in advance that your statements will be printed on high quality paper, in an intuitive format that is easy to read and understand and custom branded for your fund so investors can see and feel that your fund accounting team has taken the same care in preparing your statements as you have with every other aspect of managing your fund.