Fund Administration for Tax Season

Tax document production for alternative investment funds can be a time-consuming, distracting annual task. It doesn’t have to be. A skilled outsourced fund administration team streamlines the process. In a regulatory environment that is more stringent than ever, every kind of tax reporting is scrutinized. Federal, state and local tax filing, foreign tax filings, sales and use tax reporting, property tax reporting, income tax returns, 1065 e-filing, 1099s and K-1s must be prepared both precisely and timely. A qualified fund administration team with familiarity with your fund data and the tools to manage it provides an effective tax season process that takes the burden off fund management.

It is crucial that tax document procedures are not only accurate but completed quickly. No investor should be forced to submit an extension of their time to file individual tax returns as a result of a fund sponsor’s failure to provide K-1s or 1099s on schedule. However, many fund sponsors manage their tax reporting in-house or through their corporate CPA rather than using a specialized fund administration company to professionalize this role.

The Challenge of Tax Season Without Support from Fund Administration

The processing and delivery of tax documents by a fund administration partner is frequently resisted by fund managers in favor of in-house processing. This is a result of an incorrect understanding of the actual expenditures and risks involved. Hiring an external CPA to collaborate with in-house staff is a common strategy for many funds. Tax season without fund administration is much riskier, more expensive and complicated than it appears to be.

In order to prepare its own internal tax documents, a fund needs to hire one or more outside CPAs and allocate internal operations staff who are responsible for gathering, verifying and processing the enormous amounts of data required using internal systems that are not designed for the job, which is easily within the scope of a third-party fund administration firm. In-house processing can take months to complete and has a high potential for human error. Even once the calculations have been made and the tax form data is created, the completed forms still need to be printed and delivered – and/or submitted online. This requires additional time, expense and outside vendors and involves the increased data security risk of adding outside participants.

How the Process is Simplified by Outsourced Fund Administration

The true expenses of in-house tax document processing can be extremely high when taking into account the expenditures of internal staff, outside CPAs, printing, mailing and filing as well as the general distraction of management from core fund operations. It is not uncommon to hear fund sponsors say, “We can’t think about that this month because of tax season.” In reality, it is much more economical, accurate, quicker and less disruptive to outsource fund administration and tax processing to a professional third party. In addition to timely and affordable production of tax documents, because investors are swiftly and expertly looked after on an ongoing basis, compliance risk, key person risk and reputational risk are all eliminated. An organized strategy created by a fund administration partner that will guarantee accuracy and promptness should be in place before tax season begins for a fund. Investors who must file a tax filing extension as a result of a delayed K-1 are much less likely to reinvest with the fund responsible.

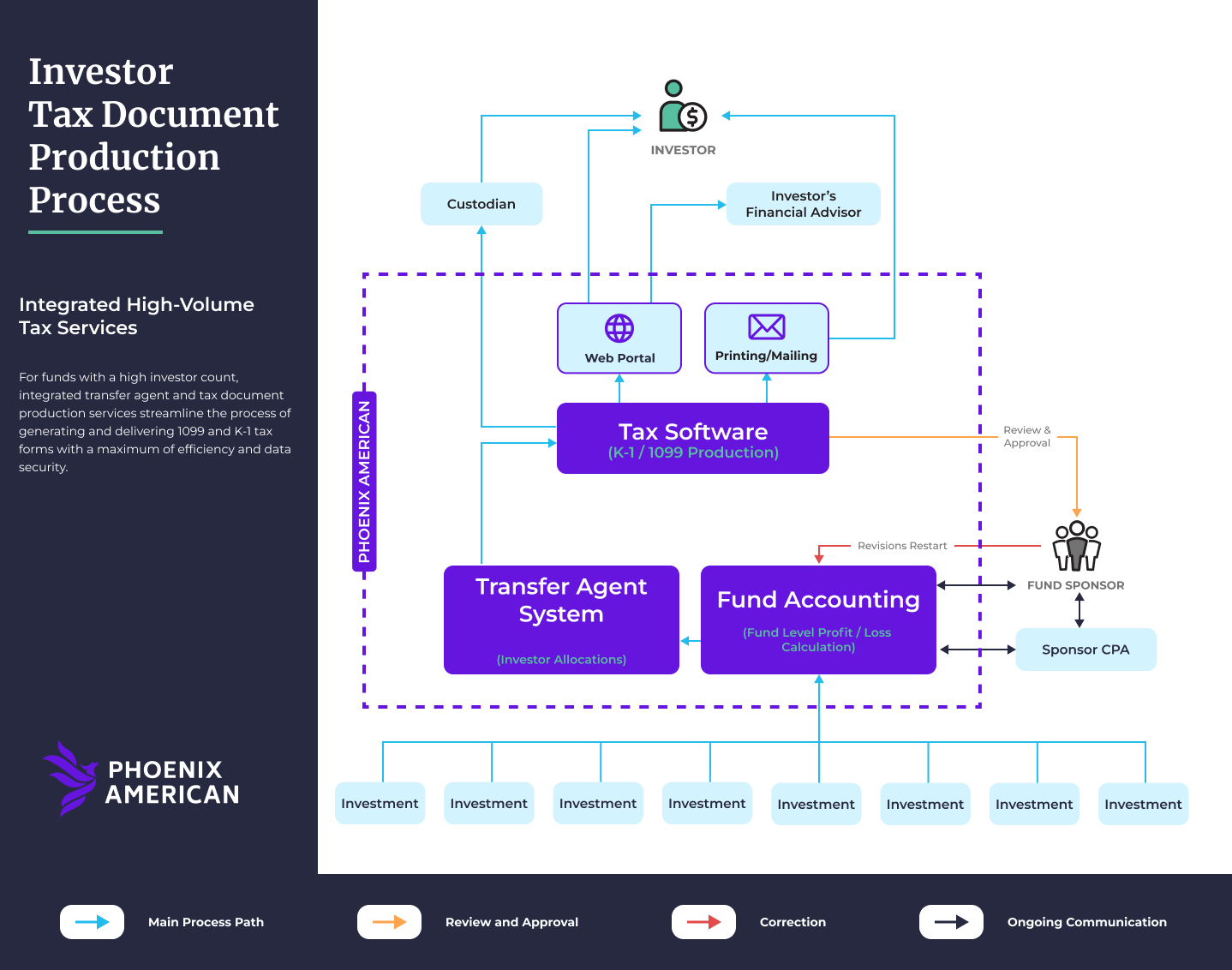

The creation of K-1s and 1099s and fulfillment of filing and reporting needs are streamlined and made easier by specialized and integrated systems that reconcile fund administration and investor data.

Delivery of Tax Documents

A fund administration provider’s high-speed printing equipment will be able to produce tax documents in any volume for fast delivery well in advance of deadlines. Systems for fund administration and printing will be completely integrated to maximize data flow, reduce effort, and guarantee data security. In order to satisfy investor needs, a sophisticated web portal that is integrated with fund administration and tax processing makes crucial tax reporting data available to investors and their financial advisors in real time in a secure and dynamic interface. This eliminates the need for mail delivery.

Fund managers will have peace of mind during tax season thanks to the systems, processes, and knowledge of outsourced fund administration for tax document production and tax filing obligations, and their employees will be free to focus on the sales and investments that underpin their success.